Understanding Forex Trading A Comprehensive Guide 1839705172

What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies on the foreign exchange market. This method of trading occurs around the clock, allowing traders to engage in transactions at any point in time, making it one of the most dynamic financial markets in the world. The Forex market attracts participants such as banks, financial institutions, corporations, governments, and retail traders. If you’re interested in diving deeper into the world of Forex, visit what is trading forex fx-trading-uz.com for more insights and resources.

The Basics of Forex Trading

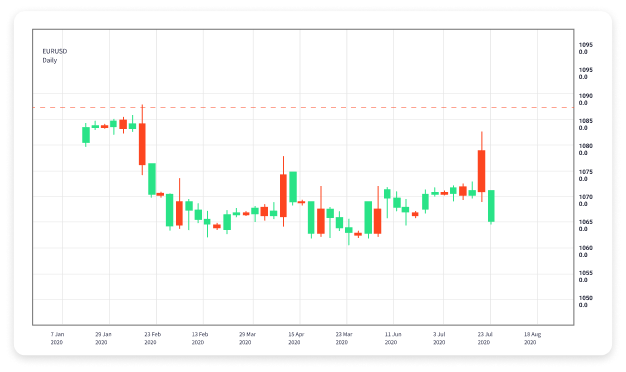

At its core, Forex trading is the process of exchanging one currency for another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, and the second is the quote currency. The value of a currency pair is determined by the exchange rate, which fluctuates based on supply and demand, economic indicators, geopolitical factors, and market sentiment.

How Forex Trading Works

In forex trading, the primary goal is to profit from the movement of currency prices. Traders speculate on whether a currency will appreciate or depreciate in value. If a trader believes that the base currency will strengthen against the quote currency, they would go “long” on the pair. Conversely, if they expect the base currency to weaken, they would go “short.”

Transactions are executed through a network of banks, brokers, and market makers. The trading process typically involves placing orders through a trading platform, where traders can access real-time market data, technical analysis tools, and trading charts.

Types of Forex Orders

In the Forex market, there are several types of orders that traders can use to manage their positions:

- Market Orders: Executed at the current market price.

- Limit Orders: Set at a specific price, executed when the market reaches that price.

- Stop Orders: Set to buy or sell once a certain price level is reached, often used for risk management.

Forex Market Participants

The Forex market consists of various participants:

- Central Banks: They hold and manage national currencies and influence monetary policy.

- Commercial Banks: These institutions facilitate currency transactions for their clients and trade on their own accounts.

- Hedge Funds and Investment Firms: They engage in currency trading as part of broader investment strategies.

- Retail Traders: Individual traders accessing the market through brokers.

Why Trade Forex?

Forex trading has become increasingly popular for several reasons:

- High Liquidity: The Forex market is the largest and most liquid financial market, with a daily trading volume exceeding $6 trillion.

- 24-Hour Market: The global nature of Forex allows for continuous trading without breaks, accommodating various time zones.

- Accessibility: With a relatively low initial capital requirement, anyone can start trading Forex.

- Leverage: Forex brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital.

Risks Involved in Forex Trading

While Forex trading offers great opportunities, it is not without risks. Here are some of the main risks involved:

- Market Risk: Currency prices can fluctuate dramatically in a short period.

- Leverage Risk: While leverage can amplify profits, it can also lead to significant losses if not managed properly.

- Counterparty Risk: The risk that a broker could default on a transaction.

- Operational Risk: Failures of technology or systems can disrupt trading.

Getting Started with Forex Trading

If you’re interested in starting your journey in Forex trading, here are key steps to follow:

1. Educate Yourself

Learn the fundamentals of Forex trading, including technical and fundamental analysis. There are numerous online resources, courses, and trading strategies to explore.

2. Choose a Reliable Broker

Research and select a reputable Forex broker that aligns with your trading style and goals. Check for regulation, trading fees, and available platforms.

3. Open a Trading Account

Once you’ve chosen a broker, open a trading account. Many brokers offer demo accounts to practice trading strategies without risking real money.

4. Develop a Trading Plan

Create a comprehensive trading plan that outlines your goals, risk tolerance, and strategies. Having a plan helps you stay disciplined and make informed decisions.

5. Start Trading

Begin by trading small amounts as you gain confidence and experience. Keep a journal of your trades to analyze your performance and refine your strategies.

Conclusion

Forex trading can be an exciting and potentially profitable venture when approached with the right knowledge and discipline. Understanding the basic concepts, risks, and techniques involved is crucial for success. As with any form of trading, it’s essential to be patient and continuously educate yourself to adapt to the ever-changing market conditions. Remember, while the Forex market can offer significant potential rewards, it also carries inherent risks. Approach it responsibly, and you may find opportunities to grow your capital through careful trading strategies.